SellSide Solutions

Connect to any Market – Route any Order – Trade any Asset Class

Advanced order routing solutions and trading platforms

OMEX

OMS / EMS for Equities and Options

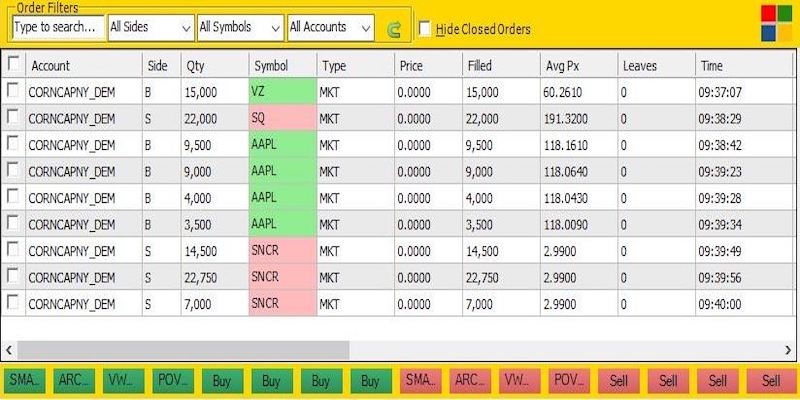

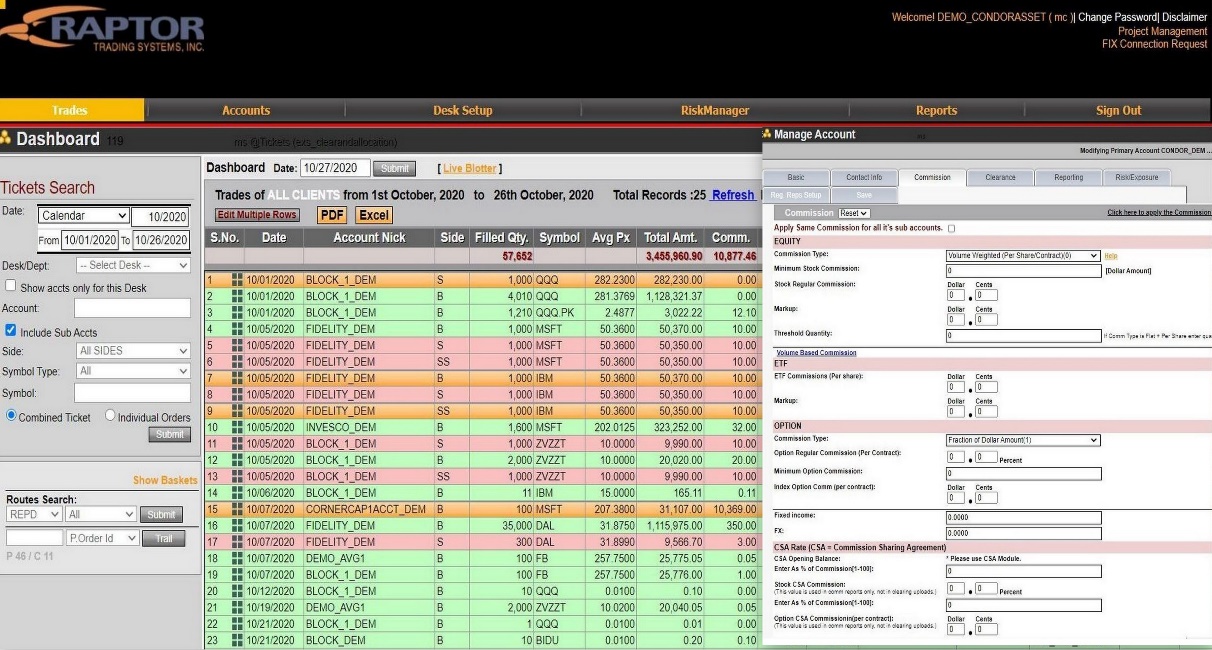

OMEX OMS/EMS provides a multi-asset Order and Execution Management system coupled with a robust Backoffice suite which includes options for clearing, accounting, and reporting – allowing for a complete Agency SellSide platform.

Our easy-to-install platform is integrated with numerous Algo providers, exchanges, and other execution facilities, resulting in a quick and easy migration process.

OMEX’s Level 2 ready system offers seamless trade through processing, including the ability to trade individual stocks and baskets, as well as full support of single and multi-leg option flows.

These key elements of the platform combined with our abundant services provide clients with fast, scalable, and reliable solutions to manage order flow, while controlling risk exposure.

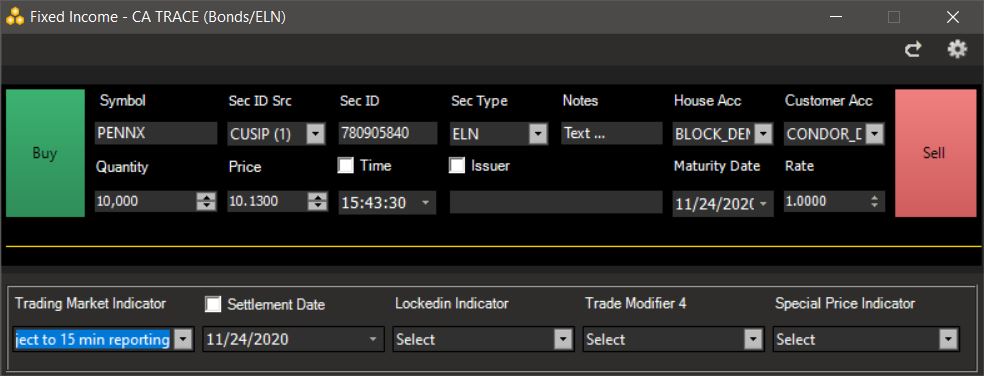

Fixed Income Books and Records

OMEX’s Fixed Income Executed Order Entry option provides firms with the ability to generate an electronic ticket which is created following the reception of an order via the phone or other messaging vehicles.

The ticket will capture all pertinent information regarding the traded order, and create a timestamp as well as an audited record.

This order ticket can be sent to the firm’s back office for management and reconciliation purposes by several departments including Risk, Operations and Compliance.

Backoffice

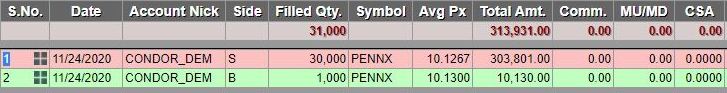

OMEX is a total workflow solution platform for firms requiring a robust and flexible system. Clients can utilize our offerings to assist with client management, allocating trades, clearing, risk management, reporting and accounting needs.

OMEX’s handling of drop copies into and out of the Backoffice allows firms to connect to domestic and international CTM platforms, interface with OMEX’s or Broker managed reporting engines, and other functions requiring dynamic trade messaging.

OMEX offers Multi Asset Commission options, Trade Processing, Complete Order/Audit Trails, a Commission Portal, CAT/OATS/606 reporting, customizable reports, and an Accounts Payable & Receivable platform to create an all-inclusive solution.

Trading HUB with Risk

Order Routing

Raptor’s Order Routing engine can serve as a light EMS with functionality to catapult an electronic trading desk to the next level. Coupled with a built-in normalization layer and proprietary business logic which provides users with full control over their entire workflow. The use of our intelligent automation logic or designing a custom routing wheel removes the need for manual intervention, while still allowing Traders the ability to step in and take control as needed.

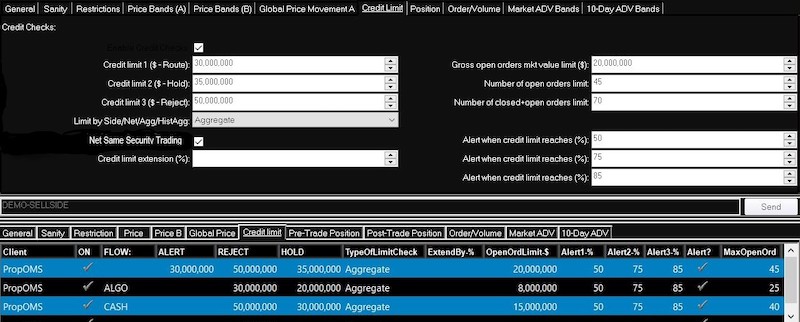

Risk Management

Raptor Risk fully manages the financial, regulatory, and other types of risks associated with market access.

The system uses pre-established guidelines for protection on each order on a client-by-client basis.

Exception Handling

Real-time updates enable traders to view and assess current trading activity with dynamic notifications on violations to reduce any exposure before routing the order to execution venues.

Flexible Order Hospital identifies exceptions and receives real-time alerts. Controls offer users the ability to instantly identify potential issues, allowing for corrective actions to be taken directly from the front end.

FIX HUB (SellSide)

Connectivity Management Portal

The platform has been designed with the flexibility to create custom solutions to handle multiple asset classes and to easily take on the most complex routing scenarios using our proprietary Raptor Scripting Language (RSL).

Internal Support and Management groups can take advantage of the dashboards showing real time views of the global client connectivity network. This will allow a total view of all details that can be utilized for monitoring, management, and reporting purposes.

Raptor’s FIX MGMT provides a variety of flexible configurations for routing globally with an eye towards global markets, Algorithms, and execution venues combined with a suite of risk management options.

Broken down into layers of functionality to allow total transparency, full suites of controls, simple multi-protocol integrations, and business intelligence layers to rapidly implement client workflow requirements.

Global Routing Network

Raptor’s global established relationships and ability to integrate with any system make it an ideal solution which can be rapidly implemented with minimal disruption. The Advanced Connectivity solution is fully integrated and certified with the key global financial networks and vendors. This service is offered as both a hosted solution in Raptor’s datacenter or within the client’s own datacenter.

With Datacenters in New York City, Baltimore, Chicago, Toronto, Sao Paulo, and more, clients can connect to any of our execution hubs (LATAM Hub, CAN Hub, US Hub, International Hub) and most exchanges, brokers, Algo providers and execution networks to access liquidity for most asset classes and global venues.

As a fintech leader, Raptor has deployed an advanced security design to protect the availability of our industry leading network. Backed by a new proprietary CSO program to stay ahead of security standards. Our expertise and experience can be leveraged to provide you with efficient and cost-effective connectivity management.

Smart IOI

Liquidity Discover

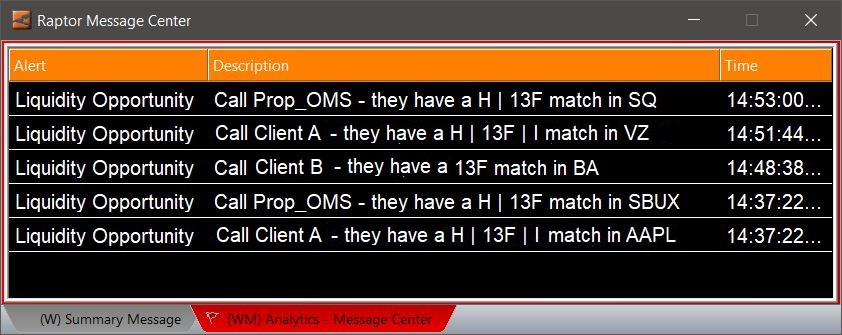

The SMART IOI platform enables clients to take advantage of the most extensive IOI functionality available. The system empowers firms with the ability to create and sustain a form of “controlled automation” which ensures that all eligible indications and advertisements are properly distributed to and viewed by targeted clients in real time.

Raptor’s built in Algorithms trigger crossing opportunities, providing all the needed information to make the right calls “now” and increase hit rates with the enhanced targeting mechanisms. IOIs sustain the High Touch product base despite firms cutting costs and moving more to an electronic trading approach.

IOI Management

The IOI Manager is an easy-to-use, intuitive user interface with simplified point and click options to monitor and manage all IOIs in a central location.

The management interface turned what is a tedious task of tracking IOI destinations for many other systems, into an effortless one-click action.

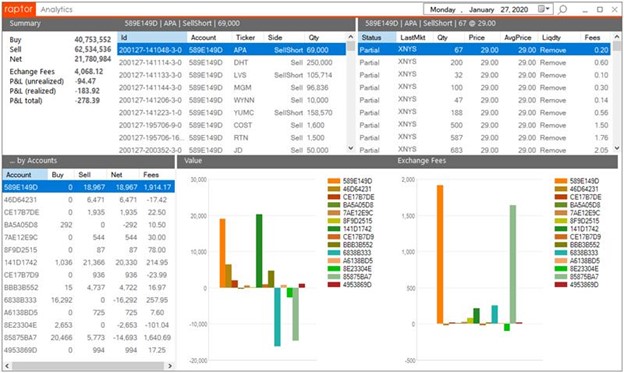

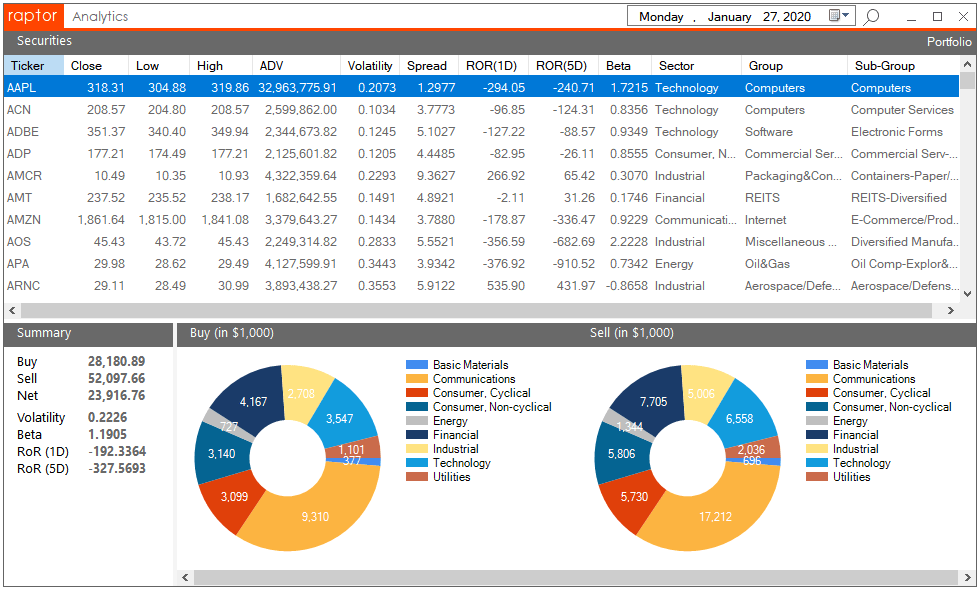

Analytics

Speedy insight into the firm’s trading volumes designed with easy-to-read dynamically updated charts.

Fed by real-time drop copies from firms trading systems, the loaded analytics tools dynamically display relevant data for securities, sectors, or other fields using custom-built dashboards.

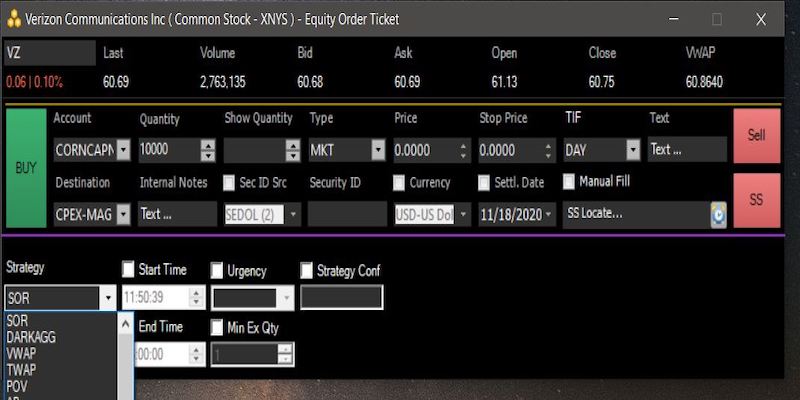

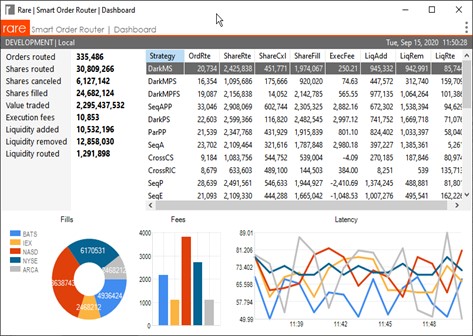

Smart Order Router (SOR)

Raptor’s SOR provides trading partners with fast and low-cost order execution while minimizing market impact. Answering the call, Raptor’s SOR selects one or more solutions from the multitude of available routing strategies.

Raptor’s SOR utilizes our new proprietary low latency FIX engine which has been certified with many global markets. The router is coupled with our powerful scripting capabilities to give trading partners enormous flexibility to create custom preferences for any of the chosen SOR strategies to fit any client’s needs.

The Dashboard contains a summary of the day's activity within our easy to navigate tables and charts. The interactive view pinpoints the amount of LIFTED and POSTED volumes, as well as FEES accrued. The views are fully customizable to show the most pertinent information for each end user.

Raptor Transaction Cost Analysis (TCA)

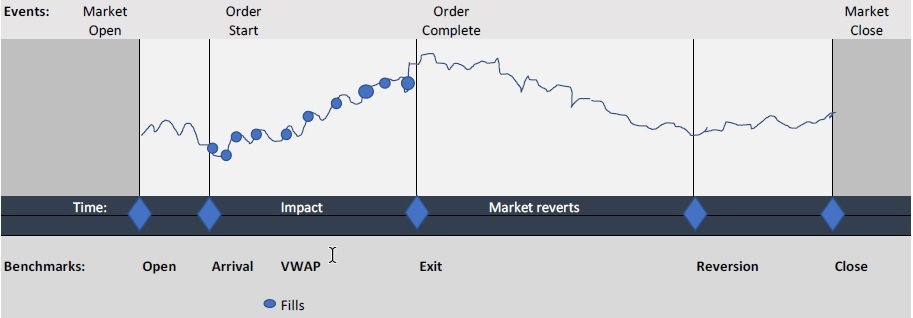

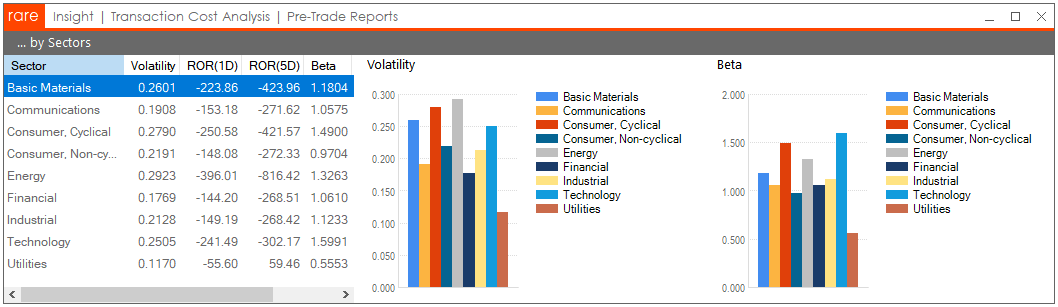

TCA is a broadly defined as the planning, monitoring and measurement of trade execution to ultimately lower the cost of trading. Raptor continues to develop the tools needed for a successful TCA; those tools are categorized as Pre-trade, Intraday, and Post-trade.

Pre-Trade

Pre-trade analysis consists of forecasting price appreciation and market impact, as well as timing risk for the specified strategy, then evaluating and selecting strategies consistent with the investment objective.

Intra-Day

Intraday analysis is intended to ensure that execution strategies are performing within expectation, measure progress against benchmarks, and explain any deviations.

Post-Trade

Post-trade analysis is the report card of execution performance. It consists of two parts: measurement of costs and evaluation of performance at the broker, trader, and algorithm level.

Raptor TCA recognizes that the analysis of fills (street trades) leads to great insight. The evolution of TCA from order to trade analysis closely examines trading endpoints with a posture to determine venue execution quality, which in turn feeds into routing policies.